Millions of working South Africans are trapped in debt stress.

credit-active consumers are over-indebted

of household income is spent on servicing debt

of debt in arrears amongst consumers

Financial stress doesn’t stay at home – it comes to work.

Employee over-indebtedness leads to:

Increased absenteeism and presenteeism

Higher staff turnover and recruitment costs

Workplace theft and fraud risk

Decreased productivity and quality of work

Safety concerns and accidents

Strained team dynamics and morale

With zero cost or administrative burden to your business, you can give your employees confidential access to trusted financial wellness, rehabilitation support, and comprehensive financial wellness resources — empowering them to tackle debt challenges and regain financial stability:

Welltec is dedicated to offering employers a robust financial wellness program and debt solution designed to assist their employees with their debt-related challenges. Our solution is offered at no cost to you as the employer and is entirely free to implement.

Sign a payroll deduction and POPIA agreement with Welltec. This unlocks preferential benefits for your employees.

We conduct a due diligence assessment on your company, and require a few documents for this process. Our team handles setup, including creating your employer profile on our financial wellness platform.

Choose from multiple roll-out options: digital toolkits for your intranet, printed collateral, on-site consultations with staff or virtual Teams introductions and sessions.

We provide continuous financial wellness communication, regular reporting on the impact of the solution and dedicated corporate consultants available across all 9 Provinces.

For employees:

For employers:

No, there is no monetary cost involved for the employer. We only require the employer to facilitate a payroll deduction service.

Yes, there is a limit. Our system includes strict rules to ensure compliance with deduction regulations, including your own deduction policies. We never deduct more than 25% of the employee’s net salary for rehabilitation loan instalments (including a credit life premium). One of our key rules is to prioritise and settle any existing payslip obligations, ensuring that this 25% cap is not exceeded. Should we offer other insurance products, the deduction will generally not exceed an additional 15% of the employee’s net salary.

No, the employer will not have any liability once the employee leaves their employment. We would, however, need the employer to inform us when an employee resigns or is terminated (retrenchment, dismissal, medically unfit etc.). From there, we will liaise directly with the employee to determine the way forward. Each credit agreement is linked to a credit life insurance policy, which covers the employee under certain conditions. Alternatively, we would transition the account to Debicheck payments.

We believe that employees who find themselves in debt traps often suffer from a lack of basic financial literacy.

Introducing a financial literacy and education program for employees will equip them with essential knowledge and tools to effectively manage their finances, thereby reducing the likelihood of relapsing into debt traps after financial rehabilitation.

By signing an SLA with a payroll deduction agreement, your employees gain access to our comprehensive debt solution.

The repayment for the rehabilitation loan is deducted from the employee's salary via payroll deduction.

This approach is necessary due to the nature of the loan. Employees who are already experiencing financial strain may not qualify for this solution if it were offered through a debit order, as it poses greater risk for the provider. By facilitating repayment through payroll deduction, we mitigate this risk, enabling us to offer a lower interest rate compared to retail providers.

Welltec is a licensed FSP in terms of the FSCA. For this reason, we are required by the FIC Act to conduct due diligence to verify and establish the identity of any person or business we engage with.

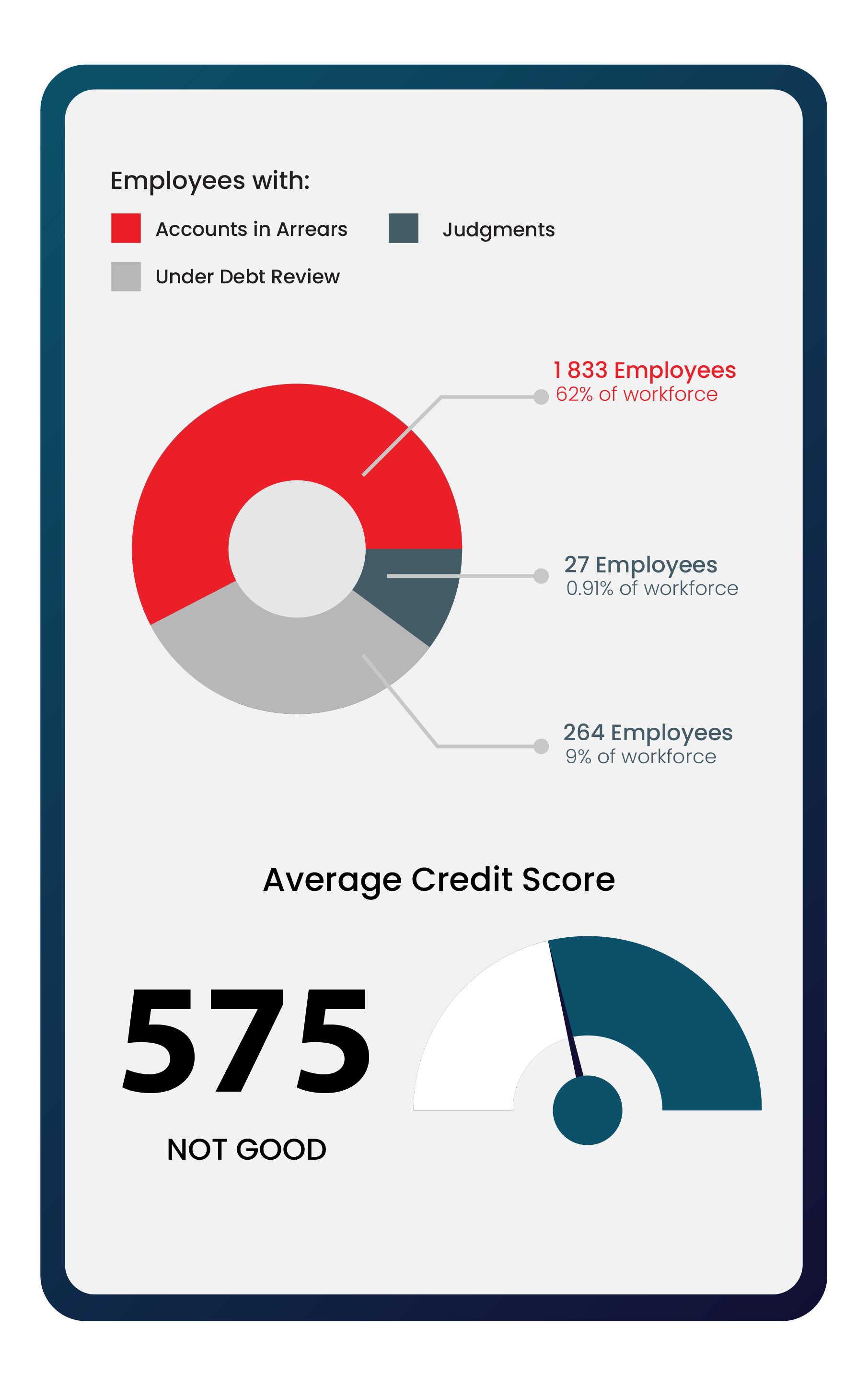

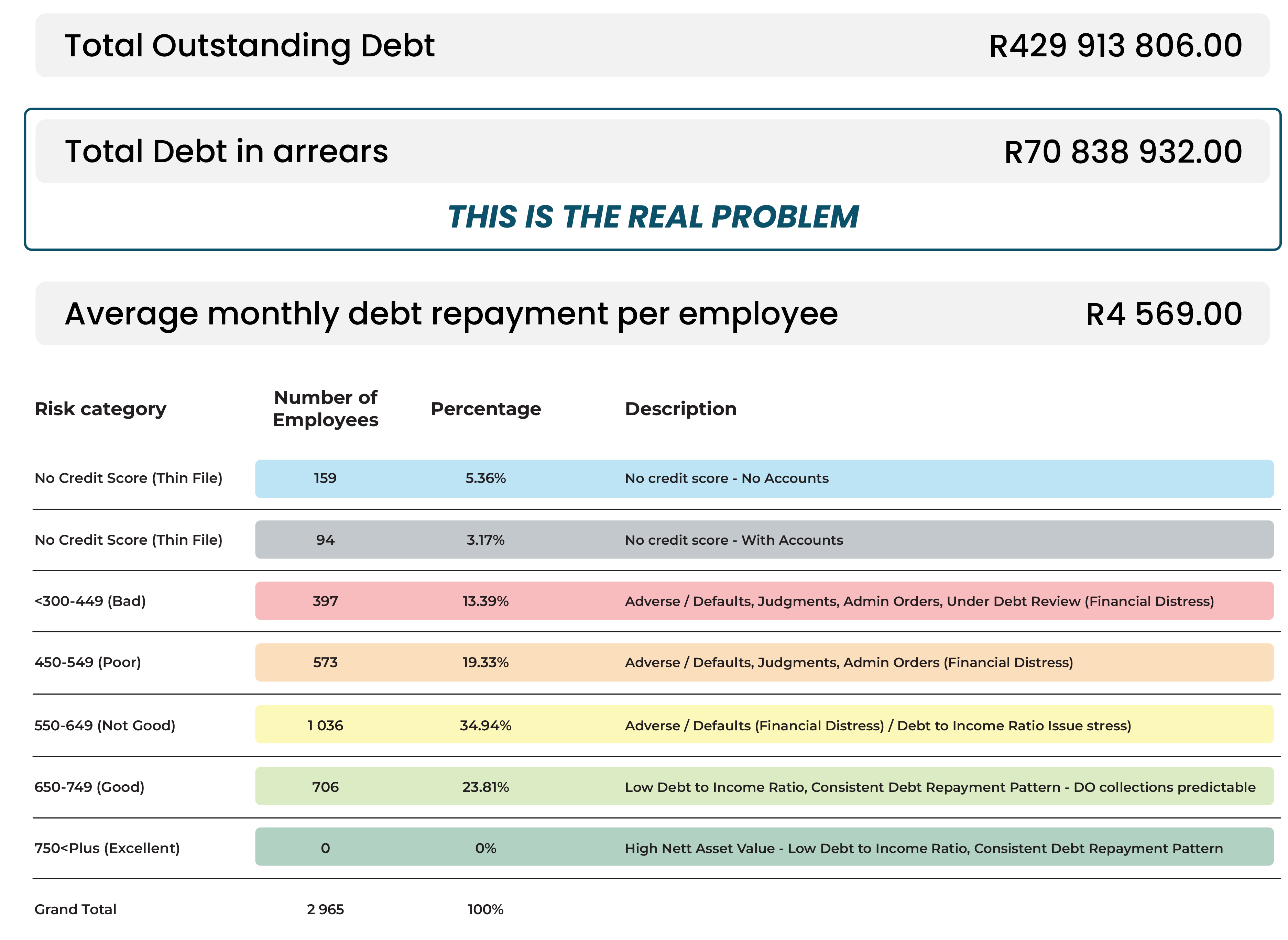

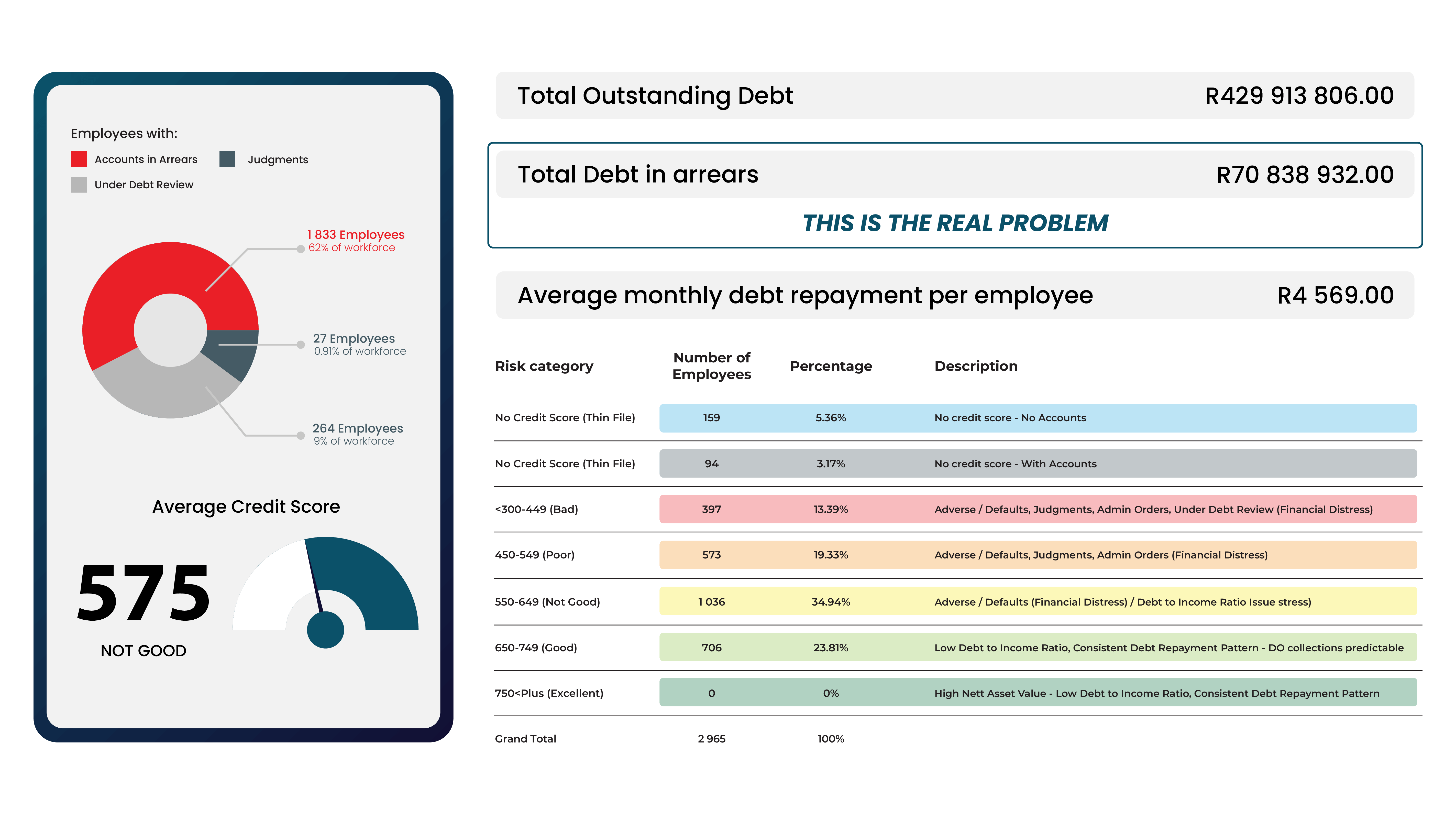

A group assessment evaluates the financial health of your entire workforce, providing a comprehensive overview of the key financial challenges your employees face.

Below is a summary of the insights you will gain from the assessment:

This data helps us identify workforce needs and refine our communication strategy to ensure employees receive the most relevant information. It also establishes a baseline metric for reporting, allowing us to track and demonstrate impact over time.

Definitely. Even though our head office resides in Gauteng, we have corporate consultants nationally and will allocate corporate consultants to all your sites outside of Gauteng.

The term debt consolidation can refer to a variety of strategies, and the specifics of each can differ. Debt Review for example is a method of consolidating debt into one reduced instalment and prohibits the member from taking up more debt until all debt has been paid up, While a consolidation loan settles debt, and so forth. All are methods of debt consolidation but follow different processes.

Debt Review:

Our Loan Offering:

Credit Restrictions: There are no credit restrictions to the member after taking up the loan, we in fact use the loan to increase affordability and put them in a better financial position.

Competitive Advantage: While debt review is part of our offering, it's integrated into a broader rehabilitation journey rather than being a standalone solution. Our holistic approach offers more than standard debt review, incorporating multiple options to support members' financial recovery.

The maximum debt amount that we can settle amounts to R200,000. However, this can vary based on several factors, including the individual's earnings, employment position, and tenure at their company.

We approach each case individually and can adjust these limits if necessary to ensure we can assist as many individuals as possible. Our primary goal is to help members improve their financial situation, and we have robust rules and policies in place to ensure that our solutions do not inadvertently worsen anyone's financial position.

This flexibility allows us to tailor our services to each member's unique circumstances, always aiming for a positive financial outcome.

Schedule a consultation with our corporate team.

Enter your details in the form and we will call you back.